Asset Depreciation Calculator

- Enter the initial purchase price (the amount you purchased the asset for)

- Enter the salvage value (how much you expect you'll be able to sell the asset for when you're done using it)

- Adjust the life of asset slider to the number of years you expect the asset will last or the number of years you plan to use the asset for.

The calculator will display how the asset will depreciate over time, the depreciable asset value, the yearly depreciation rate, and the annual depreciation.

The value of an asset will most likely decrease over time, depreciation is a way to measure by how much and how quickly an asset declines in value. Many business purchases will need to account for depreciation in order to calculate the correct tax deductions each year. Common assets that depreciate quickly include equipment, cars, phones, and even rental properties.

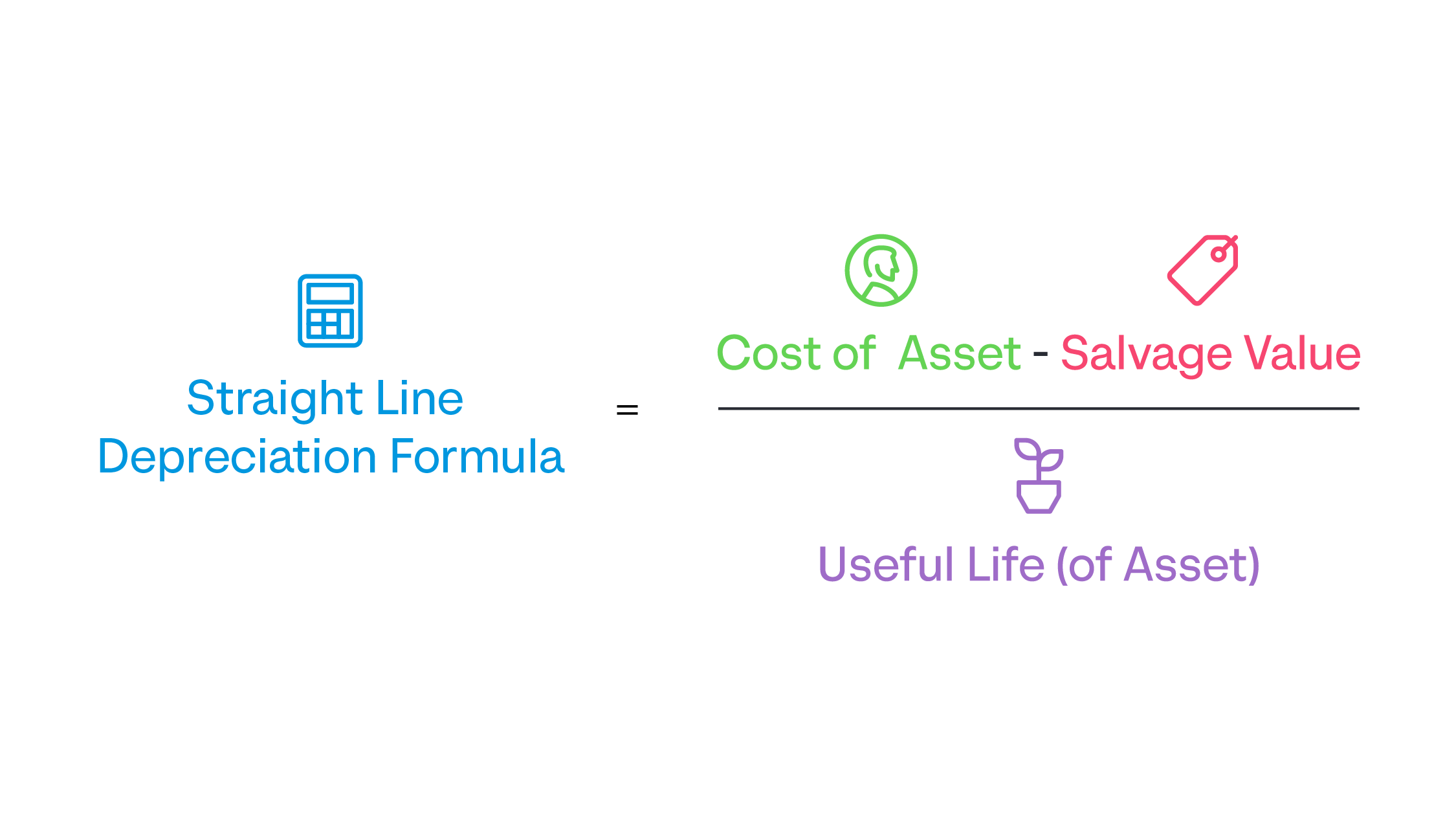

One way to calculate depreciation is to spread the cost of an asset evenly over its useful life; this is called straight line depreciation. This calculator shows how much an asset will depreciate each year—the yearly depreciation rate—using straight line depreciation.

There are four main methods to account for depreciation:

- Straight line Depreciation: The depreciation rate stays the same throughout the life of the asset (used in this calculator).

- Units-of-Production Depreciation: The more an asset is used, the faster it will depreciate. If it’s used less, it will depreciate slower.

- Sum-of-The-Years Digits Depreciation: The older the asset gets, the more it will depreciate in the same amount of time.

- Declining Balance Depreciation: The asset depreciates more at the beginning of its life and slower at the end. There’s also double-declining balance depreciation, which is the same idea but twice as fast.

Annual depreciation is equal to the cost of the asset, minus the salvage value, divided by the useful life of the asset.

Neither Banzai nor its sponsoring partners make any warranties or representations as to the accuracy, applicability, completeness, or suitability for any particular purpose of the information contained herein. Banzai and its sponsoring partners expressly disclaim any liability arising from the use or misuse of these materials and, by visiting this site, you agree to release Banzai and its sponsoring partners from any such liability. Do not rely upon the information provided in this content when making decisions regarding financial or legal matters without first consulting with a qualified, licensed professional.